There is all the time a danger of non-execution on each side of an order. When either side of an order cannot be Fundamental and Technical Analysis executed, they may not make a revenue. You can make better choices by understanding the truthful value of the security. When the market worth of a safety is greater than or equal to the intrinsic value, you should contemplate ready. However, don’t forget to pounce on undervalued property having extra intrinsic value. Trusted by over 2 Cr+ shoppers, Angel One is one of India’s leadingretail full-service broking houses.

- It is better to match the P/S ratio of comparable companies in the same industry to get a deeper understanding of how low cost or costly the inventory is.

- Hence, they assume that someday the market will reflect the accurate worth of the security.

- When considering factors like management efficiency, model recognition, and board variety, it’s referred to as qualitative evaluation.

- As the name speaks for itself, quantitative evaluation tells the story of numbers.

Fundamental Analysis Vs Technical Evaluation

It also helps analyze financial well being and administration quality, allowing traders to make good selections. Both approaches have their deserves, and investors might use them individually or together to make well-informed investment selections. Technical evaluation is like studying the patterns and movements of a stock’s price chart to foretell its future course. Investors have a look at technical knowledge similar to historic value tendencies and buying and selling volumes to grasp the place the inventory might be heading. It’s like studying the indicators of the inventory market to make knowledgeable choices on when to purchase or sell. Technical analysis is a bit like predicting a stock’s future motion by reviewing its past conduct out there.

Basic Analysis Vs Technical Evaluation

ROE can be calculated by dividing the web income by the shareholder equity. The debt-to-equity ratio (D/E) reveals how a company funds its property. The ratio shows the proportion of fairness to debt a company uses to finance its assets. A low debt-to-equity ratio means the Company uses much less debt for financing than equity via shareholders.

Get To Know The Necessary Thing Gamers Of Basic Analysis Of Stocks

Market tendencies and patterns are likely to repeat typically, and technical Analysis helps you determine these tendencies available in the market. Technical stock analysis studies historical market knowledge of price and quantity and forecasts the direction by which prices will transfer. Fundamental analysis measures the stock’s intrinsic worth by evaluating major info each at the macroeconomic and microeconomic ranges. While on the microeconomic stage, it studies the efficiency of the company, on the macro level, it monitors the business condition and economic policies affecting the sector.

Us Inventory Market High Gainers & Losers – 11th September 2024

The elements that you should determine are often referred to as (surprise surprise) ‘fundamentals’. In theory, by analyzing these factors, merchants can draw conclusions regarding the state of an economic system or a company and use them to make knowledgeable buying and selling decisions. For example, the level of employment can supply information concerning a country’s financial system and – under certain situations – can finally have an result on the demand for that country’s foreign money. Savvy investors know that they can earn cash in markets only after they buy one thing that is out of favor (i.e., towards the crowd) but which has a good chance of recovering. Generally, buyers buy shares everyone else is buying, assuming that the stock have to be affordable and price shopping for (since everyone is shopping for – bandwagon effect).

But the credibility of basic analysis has additionally questioned many as the information can simply be manipulated. Just like climate affects the plan of business, the economic system has impacts on the company’s efficiency too. In this, investors look at the essential components, similar to GDP progress, inflation, and rates of interest to view a bigger image. Investment in the securities entails risks, investor ought to seek the guidance of his personal advisors/consultant to find out the merits and dangers of investment. Investments within the securities market are subject to market threat, learn all related documents rigorously earlier than investing. This type includes evaluating non-quantifiable features of an organization, corresponding to its administration quality, brand popularity, and aggressive positioning.

Economic indicators, similar to GDP progress, inflation charges, interest rates, and unemployment figures, play a significant role in fundamental analysis. They present insights into the broader economic surroundings, influencing consumer behavior, enterprise operations, and market situations, and impression a company’s performance and prospects. The management team’s competence, strategic vision, corporate governance practices, and execution capabilities are crucial in basic analysis. A expert and effective management staff can drive company progress, handle dangers, and make sound strategic decisions that positively influence the company’s long-term performance and worth. To succeed in stock market investing, it’s essential to know each basic and technical analysis. Fundamental analysis entails evaluating a company’s monetary health, looking at factors like income, revenue margins, and growth potential.

Significance Of Elementary Analysis?

The first step in the basic evaluation of stocks is understanding the happenings on a macroeconomic level – to get a holistic view of issues. Having first studied the general financial system, analysts then gauge the strength of an business within the financial system. After that, they try to perceive the performance of a company belonging to that business. This may be referred to as the ‘top-down approach’ as it includes going from a macro level to a micro degree.

However, the truthful worth of the shares is greater as a result of the issuer has strong fundamentals. Choosing such an undervalued stock can create probabilities of capital appreciation in the future. While it can be carried out on completely different securities, it’s principally used for stock research.

Analysts of this college infer value ranges from a stock’s historic efficiency patterns which function as a buying and promoting sign, also referred to as assist and resistance respectively. That is one other point of distinction within the debate of fundamental evaluation vs technical analysis. Furthermore, the strategy also makes use of several qualitative and quantitative metrics to discover out the well-being of the corporate in query. This is another key difference between basic and technical analysis.

Investment in securities market are topic to market risks, read all of the associated paperwork carefully earlier than investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM by no means guarantee efficiency of the intermediary or provide any assurance of returns to buyers. Under this method, analysts don’t try and measure a stock’s intrinsic value. Instead, they try to determine the future worth based mostly on historic knowledge and patterns and in the end establish the proper entry and exit points. Various technical indicators are used right here to plot crucial value factors on the chart, corresponding to assist and resistance levels, which are key to identifying buying and selling opportunities.

The larger the ROA, the more efficient management is in utilising the financial sources. Both ROE and ROA reflect how properly a company utilises its resources. However, there may be one key distinction which is the method in which they deal with a company’s debt. ROA captures how a lot debt an organization carries as its whole property include all types of capital.

Investors can even use technical analysis for long-term investment by coupling it with its fundamental counterpart to achieve a extra concrete conclusion. Hence, to foolproof your research, guarantee to dive deeper into both – ocean of elementary and technical info. Opposite to top-down method, the bottom-up method seems at the individual stock’s well being first and wider the perspective. It’s like specializing in one player’s efficiency and checking its impact on the overall industry. It’s like trying at the greater picture first and narrowing it down till the final results.

It reveals how environment friendly a company is at producing cash and is an important measure to discover out if it has adequate money to reward shareholders via dividends and share buybacks. Fundamental Analysis of shares is a time-tested strategy to create sustainable wealth. In contrast, merchants seeking to make quick positive aspects by way of short-term investing favor technical Analysis. Most investors are often clueless when investing in shares as a result of they’ve yet to learn that analyzing the stocks is necessary.

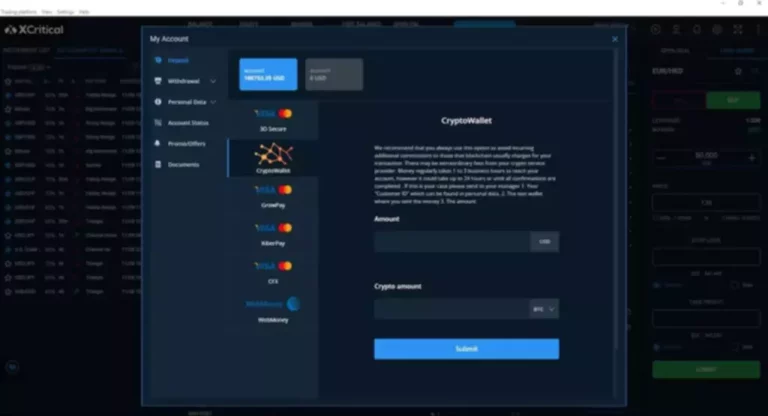

Read more about https://www.xcritical.in/ here.